UPDATED 19-Jan-2019: It’s that time of the year when the media companies have filed their “year ending” stories. The analysts, journalists and industry captains have thought about the top technology trends for 2019. You’ll hear more of artificial intelligence, machine learning, IoT, augmented reality, robotic process automation, blockchain, big data and analytics, and intelligent digital mesh. But you’ll also see a lot of activity in data centres, with companies like CtrlS, Netmagic Solutions, STT India GDC and others making huge investments in new data centres in India’s metros. A study by Colliers International projects the data centre market in India to reach $7 billion in the next two years, recording a growth rate of 25 per cent, from the current estimated level of $4.9 billion.

In this story, we discuss the factors leading to these massive investments and then list out the various hosting options.

What is driving demand for data centres in India?

We see five key drivers for the demand.

Firstly, the growing business need for cloud, hosting services and applications. Enterprises in India have now accepted cloud computing as an integral part of their business strategy. The cloud is essential for growing businesses that want to scale up infrastructure. It addresses long-standing challenges such as total cost of ownership and finding and retaining experienced engineers. It also allows an enterprise to deploy cutting-edge technology and applications through services on the cloud.

There is a demand for cloud computing; the physical infrastructure that supports it is a data centre.

Secondly, the government’s mandate for data localisation and data protection. As you may be aware, the government of India insists that all multi-national companies with customers (and consumers) in India, need to keep a copy of consumer data on local servers within India. An international credit card company, an instant messaging company, or an e-commerce company, for instance, will need to maintain mirrored servers on Indian soil; they need to keep a copy of consumer data on local servers. In fact, the draft Personal Data Protection Bill 2018 has already led multi-national corporations to prepare plans for local data centres.

All the social media companies, payments and wallet services, credit card companies, e-commerce sites, and other online services that operate overseas but have Indian customers will need local data centres.

The third driver for data centre demand is the entry of international cloud-based service providers (such as streaming services) who do not want to build their own data centres here. An example is Digital Ocean which is using Netmagic Solutions’ data centre in Bengaluru.

In 2018 we saw the entry of Alibaba, another cloud giant, which set up its first data centre in Mumbai last January. It is also collaborating with existing Cloud Service Providers (CSP) in India to set up additional availability zones in 2019.

The fourth driver is the introduction of government services and initiatives under the aegis of Digital India. The digitisation of citizen data and public records, and e-governance across states means more data in digital form. And this data needs to be stored securely. Digitization of processes such as KYC (Know Your Customer) is also increasing the volume of digital data.

The fifth driver is consumer data and services. With more affordable data plans, more users are consuming online services and generating data. Social media, streaming services, e-commerce, and the flurry of mobile apps, are all backed by beefy data centres.

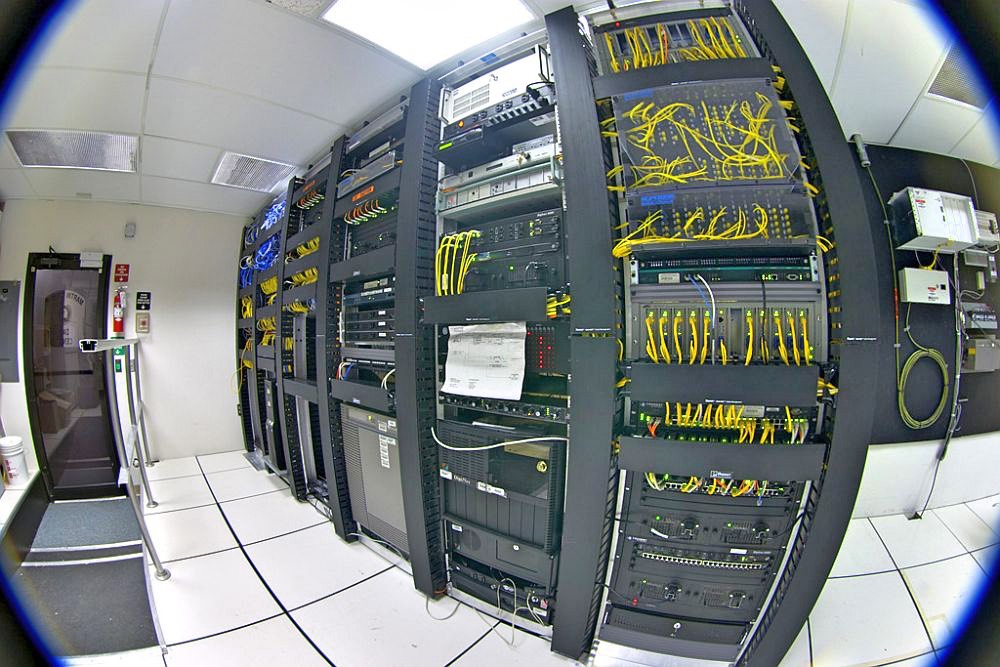

Data centre

Who’s investing in new data centres?

The cloud service providers and hosting companies in India anticipated this demand two years ago. In 2016 and 2017 DIGITAL CREED reported on Netmagic Solutions’ expansion plans. We then interviewed Sharad Sanghi, CEO, Netmagic Solutions and Sunil Gupta, Executive Director, President and COO, Netmagic solutions. They both told us that Netmagic was building new data centres in Mumbai and Bangalore. In July 2018, The Hindu Business Line reported that Netmagic already launched two data centres each in Mumbai and Bengaluru. It expects its data centre business to grow 30 – 35 per cent this financial year and plans to hire an additional 250 people.

Last week The Economic Times reported that CtrlS will invest Rs 2,000 crore to set up the world’s largest tier-4 data centre in India, In 2019, it will build a tier-4 data centre in Mumbai, followed by another facility in Hyderabad and then one in Chennai. The total investment for the three new data centres will be Rs 2,000 crore.

DC VIEWPOINT: We know that setting up a tier-4 data centre in India is not viable, given the country’s extreme environmental and climatic conditions, and erratic power supply. Most data centre providers go as far as “tier 3.5” if there is such a standard. But CtrlS has long claimed to have set up “India’s first tier-4 data centre”. That calls for building redundancy at every level, which means doubling the investment.

The Singapore-based STT Group has a JV partnership with Tata Communications in India. The Indian entity, STT India GDC is building DC3 in Bengaluru, which will be operational in 2019. It already has 15 data centres in 8 Indian cities, with an aggregated floor space of 2.15 million square feet.

Apart from these announcements, the big four cloud service providers – Microsoft, AWS, IBM, and Google – also have plans to set up more availability zones and new data centres in India.

Image: ESDS Data Centre Credit: Digital Creed

What are the hosting options?

Enterprises have a choice of setting up their own data centres in-house (commonly called ‘on-premise’ or ‘captive data centres. But that is an expensive option since data centre infrastructure needs to be constantly upgraded. Many choose to have a mix of on-premise and hosted – leasing infrastructure from CSPs. This hybrid model is very popular in India and globally. And the smaller companies and startups choose the public cloud model, with all their infrastructure hosted on the servers of a cloud service provider.

There are many cloud flavours and hosting options, and we explain these below. The applications and data (referred to as ‘workloads’) could be hosted in either of the following hosting environments offered by a CSP:

- Public cloud

- Captive data centres/on-premise

- Colocation

- Managed hosting

Here are the pros and cons of each option.

Public cloud – security can be a concern

Cloud infrastructure is multi-tenant or shared infrastructure. This allows a company to save on costs. The downside is that a company will not have complete control of its data, applications, and workloads. The cloud service provider or CSP could host this data in any country, which could pose a challenge to compliance with data protection laws centric to India.

However, the cloud does offer significant advantages such as cost savings and scalability.

Captive data centres – keep an eye on running costs

These are private data centres set up on-premise. The most significant advantage a captive data centre offers is a high degree of control. These data centres are highly customisable. But they require investment in real-estate as well as infrastructure for power, cooling, and connectivity.

Add to all that, the cost of physical security. Core systems such as power and storage will need redundancy, to ensure high availability. So that could double the investment. Typically, it can cost a business between $10 million and $25 million a year to operate a large captive data centre.

Captive data centres would seem like the ideal solution for compliance as they offer complete control. But only large businesses with good cash flow can invest in and sustain a captive data centre.

Colocation – the sweet spot for control and scalability

A public cloud offers the benefit of scaling, while a private data centre provides the highest degree of control and customisation. Colocation services offer the best of both worlds.

Colocation is a service that offers infrastructure on rent. You can rent a server and all the support that’s needed to run and maintain it – air-conditioning, power, cooling, connectivity links, storage etc. This can be beneficial to companies as they do not need to invest in real-estate and HVAC infrastructure. At most, they will need to invest in the server and the applications. But they can have complete control of their server, which is hosted on the service provider’s premises. The service provider will also offer multiple levels of physical security.

Colocation makes it easier to comply with GDPR and data protection laws since the data processor is in full control of its data assets. That brings with it an assurance that customer data (belonging to the data controller in the EU or India) will be secured. And this is very important for compliance.

Managed hosting – focus on your core

Managed hosting is similar to colocation but with a few differences. With colocation, you will have complete control of your server and applications, but any upgrades and maintenance will have to be done by yourself.

However, with a managed hosting service, that task is left to the service provider. So you can stop worrying about your infrastructure and focus on your core business. Of course, this comes at an extra cost.

Colocation vs captive

Although a large number of businesses still hold on to their in-house data centres, we see a shift to colocation and managed hosting. According to the Uptime Institute, in 2014, in-house data centers took 68% of the pie, while 25% of businesses went with colocation, and 7% of businesses went with a public cloud. In 2015, there was a small growth in the use of colocation providers. In-house data centers dropped to 65%, while colocation went up to 26%, and public clouds went up to 9%. We are now in 2019, and these figures would have changed significantly. But here are the reasons why one would prefer either colocation or captive. There are pros and cons with both.

- Managing maintenance and upgrades. With a captive data centre you have to do the maintenance and upgrades yourself and this can be a hassle. But in a colocation setting this is managed by the service provider.

- In a captive data centre you can do the upgrades and maintenance whenever you want, since you are in full control of your infrastructure. However, in a colocation setting, you have to follow the service provider’s maintenance schedule – unless you opt for fully managed hosting and have your dedicated server in their data centre.

- In a colocation data centre there is higher reliability since there is a high level of redundancy. If one component, data link or power source fails, there is a switchover to the alternate or backup source. It would be difficult and expensive to provide this level or redundancy and reliability in a captive data centre.

- The infrastructure – cooling, power, storage, connectivity, real estate – are shared in a colocation data centre and hence the costs are shared. Hence the colocation service provider can offer better rates to customers as against a customer negotiating directly with a power company, for instance.

- In a colocation data centre there are dedicated and experienced staff and hence you can expect a high level of service and support. But in a captive data centre, it may be difficult and expensive to retain experienced staff, who would look elsewhere for opportunities.

- Compliance to industry standards is assured in a colocation data centre, since their customers demand this, and it is backed by SLAs.

- Scaling up the infrastructure in a captive data centre can be a challenge as additional resources need to be procured following a long order process, bound by budgets.

Conclusion

The Personal Data Protection Bill 2018 is expected to be passed in parliament in 2019 (post elections). This will lead to further demand for data centres. The ecosystem will also benefit, with data centre infrastructure companies such as Sterling and Wilson (a division of Shapoorji Pallonji & Company Pvt Ltd) already firming up plans to build more infrastructure for data centre companies.