(272 Views)

Ahead of the Gartner Symposium/ITexpo, Stessa Cohen, Research Director, Gartner told us how banks and solution providers should prepare for digital banking platforms

Q. How do you define the Emerging Market of Digital Banking Platforms? How does it bring all stakeholders together on one platform?

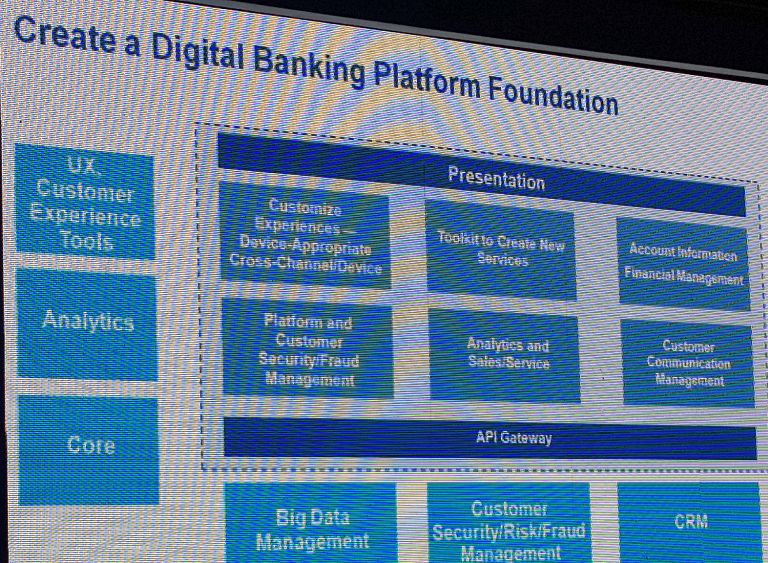

Stessa Cohen: There is a definition for this called Open Unified Digital Banking Platform. The technology is open in the sense that it allows applications to integrate with the use of APIs and API gateways, that allow for integration with not only the bank’s applications but also third-party applications. It unifies a lot of functionality that is often done in product and channel silos today. We see redundant customer transactions and customer communications for every new channel created. Take account opening for instance. It is around digital banking because the goal of the bank is to create new digital assets; that is products and services that can be created with digital technology, but not delivered only to digital devices. It could also include the branch and the contact centre. Digital encompasses all of banking. And it is a platform because it is pushing out services and also taking in services and creating new services. It is not just delivering transactions but it is about managing customer experiences.

Stessa Cohen says banks need to take a hard look at the multi-channel solutions that they have and ask if these meet the criteria needed for Open Unified Digital Banking Platforms

Q. Why do you call it ‘emerging’? What have you observed in the evolution of banking and financial services so far? How have solutions providers evolved?

When I started working on my Market Guide, there were the traditional financial services for banking from niche vendors that were covered in many other ways and they had solutions. Then some of the banking providers pivoted and focussed on the omni-channel banking approach. And then I started to see newer providers like BackBase and Liferay (Open Source portals). They are coming into the banking arena with a solution that had customers from other industries using it. I also saw some horizontal customer experience centres. For instance, SAP has a horizontal customer experience solution. So does Adobe and there are others that have this customer experience platforms that they are also positioned at banks.

I also saw vendors coming from being system integrator providers to have complete digital frameworks for bank processes. And then I started seeing the newer emerging vendors — the emerging digital banking providers who are not legacy providers but they have been around 5 – 10 years. And then there were a large amount of startups emerging in different parts of the world that are providing similar capabilities as well. So I am learning about new providers all the time. Ever since I started my Market Guide there are many providers that I have discovered. For example one provider comes from the card services. They have a platform that supports banking.

That’s why I call this an emerging category. New or emerging providers are entering this space with new technology and new solutions. Traditional providers have created digital banking solutions too. So there is a mix.

Q. Gartner predicts that by the end of 2019, 25% of retail banks will use solutions from startups and emerging providers to replace legacy online and mobile banking systems. That means traditional providers will suffer huge losses or go out of business. So what do you think will really happen?

I see one direction that they (traditional providers) are taking; they are telling the banks that they are not going to integrate with the new delivery platforms. They will not let them integrate with the core banking system. In psychology they call that ‘negative motivation’. Some banks say “we will stay with you because we have to.”

I am not sure if that approach is going to work, because I speak to bank clients around the world daily, and they say they want to try something new for a number of reasons. And they are willing to go with relatively new vendors who have been around for less than five years. It is a risky thing to do but they are willing to try it because they are under a lot of pressure to keep up in the market place, especially with customer experiences, not just consumer banking. It is about the ability to add new capabilities especially in areas like artificial intelligence, machine learning, collaborative tools — at a rapid rate. We see a new chatbot for banking every day. But they need to do things quickly. They do not have 18 months to do that. They (banks) want it sooner, because the consumers have changed. They need to react faster to the technology and the customer experiences.

Banks need to take a hard look at the multi-channel solutions that they have and ask if these meet the criteria needed for Open Unified Digital Banking Platforms.

Some banks may choose to adopt the new solutions but still leave the (traditional) channel solutions intact. And that’s going to create problems for their customers. They need to work towards ‘no channel applications’. They need to be able to do things like understanding how customers are interacting with their financial services, using different devices. They need to be able to take metadata from those activities to understand their customers better. They can’t do that if everything is siloed. It becomes very difficult.

The other thing is that the banks could just do acquisitions (of emerging solutions providers). They could also develop a partnership with the provider.

Some good examples are DBS Bank with their digibank solutions and Hello bank! in Europe.

—————————————————————————————————————